What buyers & sellers need to know right now.

1. Inventory in Wisconsin is rising — finally giving buyers breathing room

After years of tight supply, Milwaukee and surrounding counties are seeing more homes hit the market, especially in the $250K–$450K range.

• More options = less bidding-war pressure

• Sellers can no longer “test the market” with overpricing

• Proper pricing + great presentation = strongest results

This trend mirrors the national shift toward a more balanced market, not a buyer’s or seller’s market.

⸻

2. Mortgage rates expected to ease slightly into 2026

Forecasts show 30-year rates may dip toward 6.3% in 2026.

For buyers, this means affordability slowly improves.

For sellers, this may bring more qualified buyers into the pool after winter.

Wisconsin buyers are extremely payment-sensitive — even a small rate dip changes activity.

⸻

3. Prices are flattening — but NOT collapsing

Wisconsin is considered a stable market.

• Expect 1–3% price growth in 2026

• Not the double-digit boom

• Not the crash headlines of coastal markets

Homes in good condition and priced correctly still move FAST — your own listings prove this, Cynthia.

⸻

4. The winter slowdown in WI is milder than usual

Historically, December–January chills the market.

NOT THIS YEAR.

Because buyers are chasing limited inventory, winter active buyers are more serious than ever.

Sellers who list now face less competition versus waiting until spring — which is expected to bring a flood of new listings.

This is a strategic selling window.

⸻

5. Buyers are requesting more repairs & credits

Due to:

• Higher rates

• Tighter inspection standards

• More homes to choose from

Buyers are pushing harder for:

• Roof reports

• Furnace/boiler service

• Electrical upgrades

• Closing credits

This is exactly what you’re seeing with your deals — it’s not random; it’s the trend.

Sellers must prepare for negotiation, not assume 2021-style leverage.

⸻

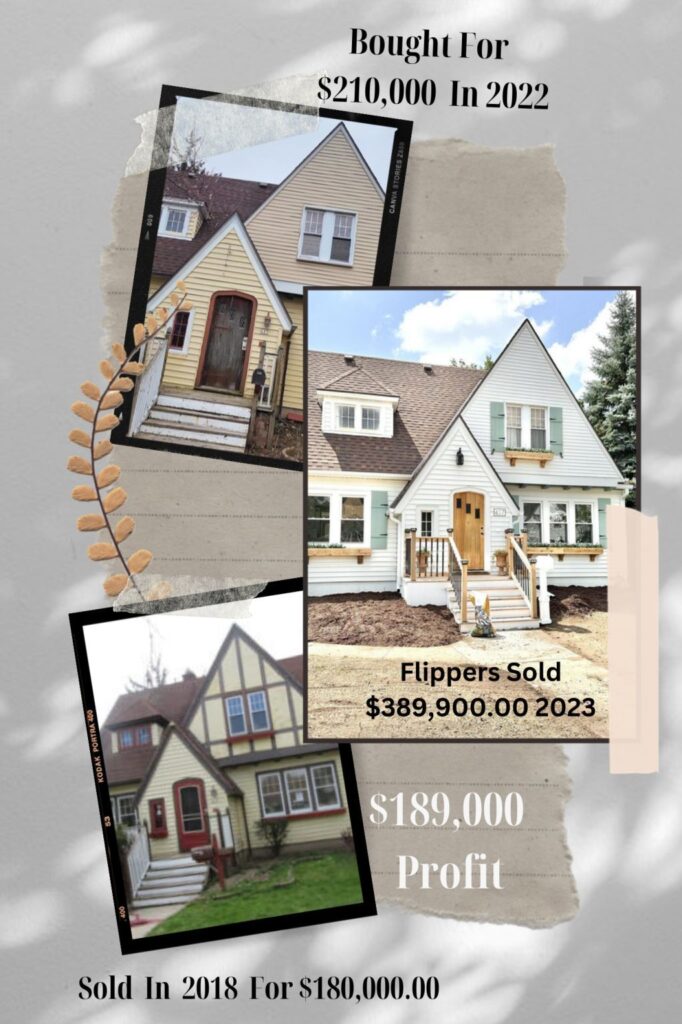

6. Investor activity is rising again — especially duplexes & starter homes

Milwaukee is an investor magnet because:

• Cash-flow properties under $300K

• Strong rental demand

• Lower taxes vs coastal markets

Expect investors to stay active in 2026, but more disciplined on price.

Great opportunity for sellers owning rentals.

⸻

7. Outlook for 2026: “A Mild Reset, Not a Rollercoaster”

Wisconsin’s forecast:

• Slightly lower rates

• Modest price increases

• More inventory

• More negotiation

• More first-time buyers re-entering

This is the most normalized market we’ve seen in 5 years.

Contact wwww.SoldByWollersheim.com

To help you through the Wisconsin Real Estate market.

#forbes#forbesglobalproperties #luxury #luxuryglobalproperties

#luxurypropertiesinwauwatosa

#luxuryhomesinBrookfield

#luxurarylakeproperties #luxurylakecondos #robbreport #tedtalks

#luxurylakepropertiesinPewaukee

#luxurylakepropertiesonLakeMichigan

#fixerupper